The Great Inflexion

Avida employs a collection of senior pension professionals whose experience spans more than three decades.

In our view events of the last three years amount to a 'Great Inflexion' in UK pensions, across DB and DC. The news is surprisingly good though. We think Opportunities outweigh Threats, but Trustees, Businesses, Providers and Executive teams will need to re-point.

Avida can help by assessing the risks and opportunities to your own circumstances, enabling you to plan your future and repoint accordingly. We can also help you with implementation, and if needs be, provide interim project and executive support.

Avida employs a collection of senior pension professionals whose experience spans more than three decades. In our view events of the last three years amount to a 'Great Inflexion' in UK pensions, across DB and DC. The news is surprisingly good though. We think Opportunities outweigh Threats, but Trustees, Businesses, Providers and Executive teams will need to re-point.

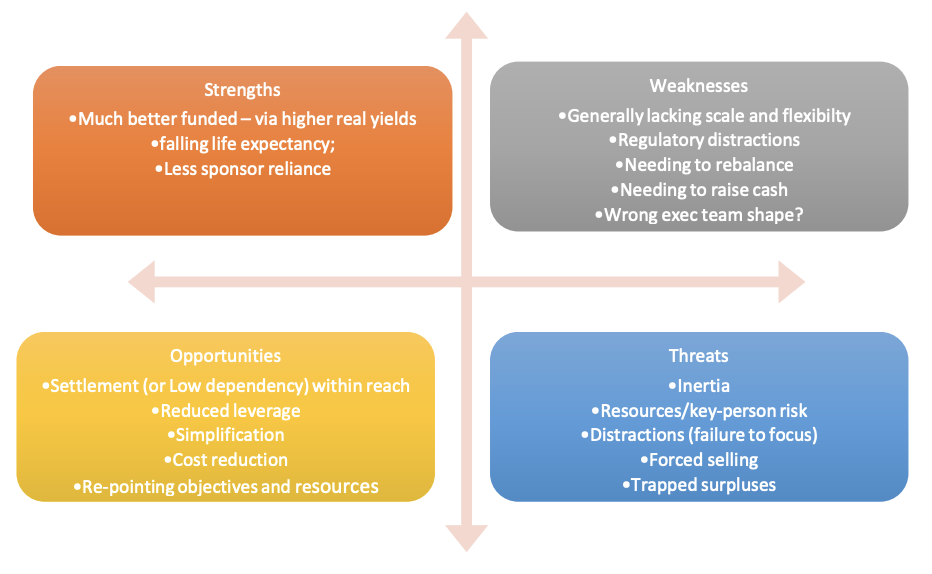

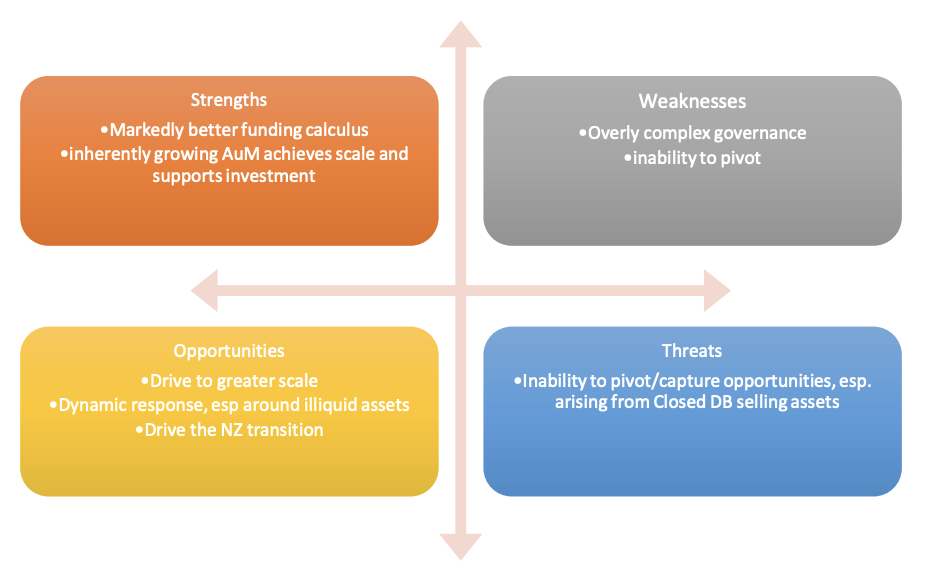

To illustrate, consider the following SWOT analysis for three market segments:

Closed Defined Benefits

Opened Defined Benefits (mainly public sector)

Defined Contribution

Of course, some schemes may not naturally fall into these segments, but most will and hopefully recognise the issues.

Conclusions:

Our analysis is high level, but three common themes emerge: 1. The last three years amount to a 'Great Inflexion', the change is significant 2. Threats exist but are far outweighed by the Opportunities. Closed DB seemingly presents the greatest opportunity. By the same token, risks and downside of not acting (i.e., inertia through maintaining existing operating models) is also highest 3. A re-pointing of trustee/business objectives and executive team resourcing will likely be necessary to capture Opportunities across all three sectors Avida can help by assessing the risks and opportunities to your own circumstances, enabling you to plan your future and repoint accordingly. We can also help you with implementation, and if needs be, provide interim project and executive support.